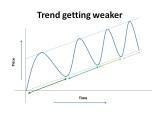

Stock market trading is not an easy subject, as a professional trader, I understand how much tough it is. Understanding market behaviour is the most important part. Many people use oscillators and indicators to understand market behaviour. But price action is the best way to understand market movement whatever it is reversal or continuation. Most people lose money during any reversal. When common traders find out reversal happens it is too late actually.

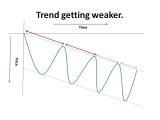

A trader must understand the reversal or continuation signal what the market gives us far before it happens. Mean, before entering into a downtrend or before giving any down move in the price market warn us far before it happens. If you know how to read the market warning you can easily utilise the opportunities.

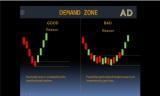

Candlesticks behaviour is one of the most important signals out of many but the best. A regimented candlestick combination tells us so many things about the market reversal and continuation.

In this class, you will learn

- How to understand whether the market or price will reverse or not?

- How to understand if the momentum will continue or not?

- How to understand market strength in depth?